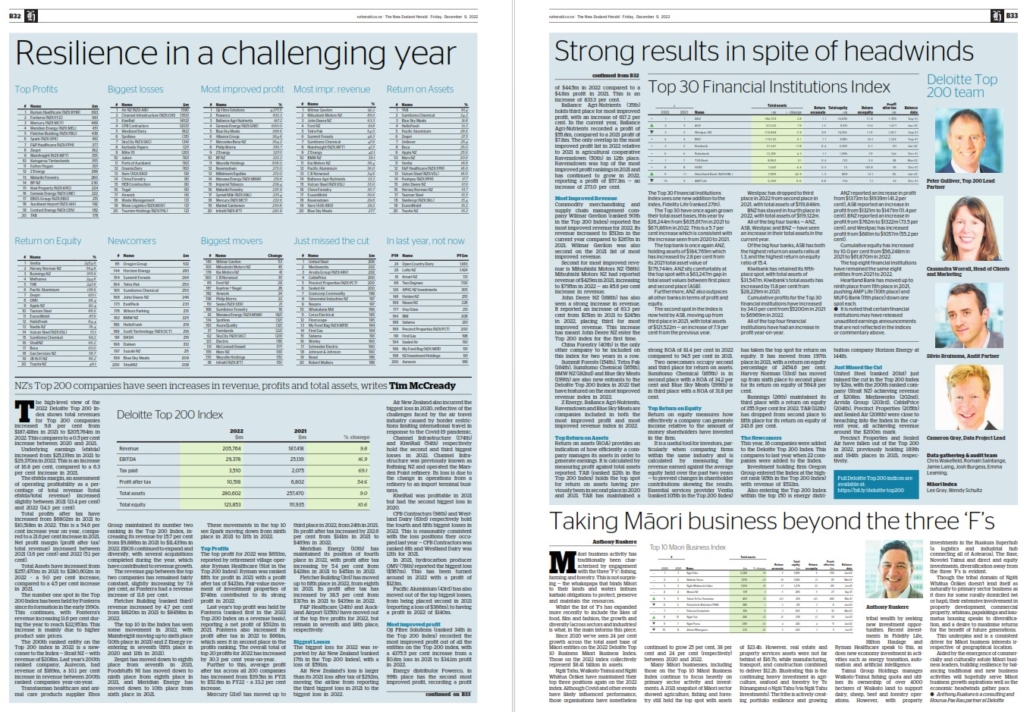

Deloitte Top 200: Resilience in a challenging year

The high-level view of the 2022 Deloitte Top 200 Index shows total revenues for Top 200 companies increased 9.8 per cent from $187,418m in 2021 to $205,764m in 2022. This compares to a 0.5 per cent increase between 2020 and 2021.

Underlying earnings (ebitda) increased from $25,139m in 2021 to $29,370m in 2022. This is an increase of 16.8 per cent, compared to a 6.3 per cent increase in 2021.

The ebitda margin, an assessment of operating profitability as a percentage of total revenue (total ebitda/total revenue) increased slightly between 2021 (13.4 per cent) and 2022 (14.3 per cent).

Total profits after tax have increased from $6802m in 2021 to $10,518m in 2022. This is a 54.6 per cent increase year on year, compared to a 21.6 per cent increase in 2021. Net profit margin (profit after tax/total revenue) increased between 2021 (3.6 per cent) and 2022 (5.1 per cent).

Total Assets have increased from $257,470m in 2021 to $280,602m in 2022 – a 9.0 per cent increase, compared to a 4.5 per cent increase in 2021.

The number one spot in the Top 200 Index has been held by Fonterra since its formation in the early 1990s. This continues, with Fonterra’s revenue increasing 11.6 per cent during the year to reach $22,953m. This increase is mainly due to higher product sale prices.

The 200th-ranked entity on the Top 200 index in 2022 is a newcomer to the Index — Strait NZ — with revenue of $208m. Last year’s 200th ranked company, Aurecon, had revenue of $189m, a 10.1 per cent increase in revenue between 200th ranked companies year-on-year.

Transtasman healthcare and animal care products supplier Ebos Group maintained its number two ranking in the Top 200 Index, increasing its revenue by 15.7 per cent from $9,886m in 2021 to $11,439m in 2022. EBOS continued to expand and diversify, with several acquisitions completed during the year, which have contributed to revenue growth.

The revenue gap between the top two companies has remained fairly constant, slightly increasing by 7.8 per cent, as Fonterra had a revenue increase of 11.6 per cent.

Fletcher Building (ranked third) revenue increased by 4.7 per cent from $8120m in 2021 to $8498m in 2022.

The top 10 in the Index has seen some movement in 2022, with Mainfreight moving up to the sixth place (10th place in 2021) and Z Energy re-entering in seventh (fifth place in 2020 and 11th in 2021).

Zespri has moved down to eighth place from seventh in 2021, Foodstuffs NI has moved down to the ninth place from eighth place in 2021, and Meridian Energy has moved down to 10th place from sixth place in 2021.

These movements in the top 10 see Spark moving down from ninth place in 2021 to 11th in 2022.

Top Profits

The top profit for 2022 was $693m, reported by retirement village operator Ryman Healthcare (91st in the Top 200 Index). Ryman was ranked fifth for profit in 2021 with a profit after tax of $423m. Fair-value movement of investment properties of $746m contributed to its strong profit in 2022.

Last year’s top profit was held by Fonterra (ranked first in the 2022 Top 200 Index on a revenue basis), reporting a net profit of $532m in 2021. Fonterra also increased its profit after tax in 2022 to $661m, which sees it in second place in the profits ranking. The overall total of top 20 profits for 2022 has increased by 30.3 per cent year-on-year.

Further to this, the average profit after tax across all 200 companies has increased from $39.5m in FY21 to $52.6m in FY22 – a 33.2 per cent increase.

Mercury (21st) has moved up to third place in 2022, from 24th in 2021. Its profit after tax increased by 232.6 per cent from $141m in 2021 to $469m in 2022.

Meridian Energy (10th) has maintained its position of fourth place in 2022, with profit after tax increasing by 5.4 per cent from $428m in 2021 to $451m in 2022.

Fletcher Building (3rd) has moved up to fifth place in 2022, from eighth in 2021. Its profit after tax has increased by 38.5 per cent from $317m in 2021 to $439m in 2022.

F&P Healthcare (24th) and Auckland Airport (135th) have moved out of the top five profits for 2022, but remain in seventh and 18th place, respectively.

Biggest Losses

The biggest loss for 2022 was reported by Air New Zealand (ranked 17th in the Top 200 Index), with a loss of $591m.

Air New Zealand’s loss is larger than its 2021 loss after tax of $292m, moving the airline from reporting the third biggest loss in 2021 to the biggest loss in 2022.

Air New Zealand also incurred the biggest loss in 2020, reflective of the challenges faced by the air travel industry caused by border restrictions limiting international travel in response to the Covid-19 pandemic.

Channel Infrastructure (174th) and KiwiRail (54th) respectively hold the second and third biggest losses in 2022. Channel Infrastructure was previously known as Refining NZ and operated the Marsden Point refinery. Its loss is due to the change in operations from a refinery to an import terminal business.

KiwiRail was profitable in 2021 but had the second biggest loss in 2020.

CPB Contractors (98th) and Westland Dairy (63rd) respectively hold the fourth and fifth biggest losses in 2022. This is reasonably consistent with the loss positions they occupied last year — CPB Contractors was ranked 8th and Westland Dairy was 12th for 2021.

In 2021, hydrocarbon producer OMV (78th) reported the biggest loss ($567m). This has been turned around in 2022 with a profit of $123m.

Pacific Aluminium (43rd) has also moved out of the top biggest losses, from being placed second in 2021 (reporting a loss of $366m), to having a profit in 2022 of $140m.

Most improved profit

Oji Fibre Solutions (ranked 34th in the Top 200 Index) recorded the most improved profit out of all the entities on the Top 200 index, with a 4375.5 per cent increase from a $0.8m loss in 2021 to $34.1m profit in 2022.

Energy distributor Powerco, in 99th place, has the second most improved profit, recording a profit of $44.5m in 2022 compared to a $4.8m profit in 2021. This is an increase of 833.3 per cent.

Ballance Agri-Nutrients (35th) holds third place for most improved profit, with an increase of 617.2 per cent. In the current year, Ballance Agri-Nutrients recorded a profit of $55.8m, compared to a 2021 profit of $7.8m. The only overlap in the most improved profit list in 2022 relative to 2021 is agricultural cooperative Ravensdown (50th) in 12th place. Ravensdown was top of the most improved profit rankings in 2021 and has continued to grow in 2022, reporting a profit of $57.3m — an increase of 273.0 per cent.

Most Improved Revenue

Commodity merchandising and supply chain management company Wilmar Gavilon (ranked 90th in the Top 200 Index) reported the most improved revenue for 2022. Its revenue increased to $513m in the current year compared to $267m in 2021. Wilmar Gavilon was also second on the 2021 list of most improved revenue.

Second, for most improved revenue is Mitsubishi Motors NZ (58th). Mitsubishi Motors NZ had reported revenue of $429m in 2021, increasing to $795m in 2022 — an 85.6 per cent increase in revenue.

John Deere NZ (168th) has also seen a strong increase in revenue. It reported an increase of 63.3 per cent from $151m in 2021 to $245m in 2022, placing third for most improved revenue. This increase has meant John Deere NZ enter the Top 200 index for the first time.

China Forestry (40th) is the only other company to be included on this index for two years in a row.

Summit Forests (154th), Tetra Pak (164th), Sumitomo Chemical (165th), BMW NZ (182nd) and Blue Sky Meats (199th) are also new entrants to the Deloitte Top 200 Index in 2022 that have featured on the most improved revenue index in 2022.

Z Energy, Ballance Agri-Nutrients, Ravensdown and Blue Sky Meats are companies included in both the most improved profit and most improved revenue index in 2022.

Top Return on Assets

Return on assets (ROA) provides an indication of how efficiently a company manages its assets in order to generate earnings. It is calculated by measuring profit against the total assets reported. TAB (ranked 112th in the Top 200 Index) holds the top spot for return on assets having previously been in second place in 2020 and 2021. TAB has maintained a strong ROA of 81.4 per cent in 2022 compared to 94.5 per cent in 2021.

Two newcomers occupy the second and third place for return on assets. Sumitomo Chemical (165th) is in second place with a ROA of 34.2 per cent and Blue Sky Meats (199th) is in third place with a ROA of 31.8 per cent.

Top Return on Equity

Return on equity measures how effectively a company can generate income relative to the number of money shareholders have invested in the firm.

It is a useful tool for investors, particularly when comparing firms within the same industry and is calculated by measuring the revenue earned against the average equity held over the past two years — to prevent changes in shareholder contributions from skewing the results. Essential services provider Ventia (ranked 105th in the Top 200 Index) has taken the top spot for return on equity. It has moved from 197th place in 2021, with a return on equity percentage of 2454.6 per cent. Harvey Norman (33rd) has moved up from sixth place to second place for its return on equity of 564.8 per cent.

Bunnings (26th) maintained its third place with a return on equity of 355.9 per cent for 2022. TAB (112th) has dropped from second place to fifth place for its return on equity of 243.6 per cent.

The Newcomers

This year, 16 companies were added to the Deloitte Top 200 Index. This compares to last year when 22 companies were added to the Index.

Investment holding firm Oregon Group entered the Index at the highest rank (85th in the Top 200 Index) with revenue of $532m.

Also entering the Top 200 Index within the top 150 is energy distribution company Horizon Energy at 144th.

Just Missed the Cut

United Steel (ranked 201st) just missed the cut in the Top 200 Index by $2m, with the 200th ranked company (Strait NZ) achieving revenue of $208m. Mediaworks (202nd), Arvida Group (203rd), CablePrice (204th), Precinct Properties (205th) and Sealed Air (206th) were close to breaching the Index in the current year, all achieving revenue around the $200m mark.

Precinct Properties and Sealed Air have fallen out of the Top 200 in 2022, previously holding 189th and 194th places in 2021, respectively.

Top 30 Financial Institutions Index

The Top 30 Financial Institutions Index sees one new addition to the index, Fidelity Life (ranked 27th).

The Top 30 have once again grown their total asset bases, this year by $36,244m from $635,617m in 2021 to $671,861m in 2022. This is a 5.7 per cent increase which is consistent with the increase seen from 2020 to 2021.

The top bank is once again ANZ, holding assets of $184,769m which have increased by 2.8 per cent from its 2021 total asset value of $179,744m. ANZ sits comfortably at the top spot with a $63,247m gap in total asset values between first place and second place (ASB).

Furthermore, ANZ also outpaces all other banks in terms of profit and equity.

The second spot in the Index is now held by ASB, moving up from the third place in 2021, with total assets of $121,522m — an increase of 7.9 per cent from the previous year.

Westpac has dropped to third place in 2022 from second place in 2021, with total assets of $119,848m.

BNZ has stayed in fourth place in 2022, with total assets of $119,122m.

All of the big four banks — ANZ, ASB, Westpac and BNZ — have seen an increase in their total assets in the current year.

Of the big four banks, ASB has both the highest return on assets ratio at 1.3, and the highest return on equity ratio of 15.4.

Kiwibank has retained its fifth-place spot, with total assets of $31,547m. Kiwibank’s total assets have increased by 11.8 per cent from $28,229m in 2021.

Cumulative profits for the Top 30 financial institutions have increased by 34.0 per cent from $5200m in 2021 to $6969m in 2022.

All of the top four financial institutions have had an increase in profit year-on-year.

ANZ reported an increase in profit from $1373m to $1939m (41.2 per cent), ASB reported an increase in profit from $1321m to $1471m (11.4 per cent), BNZ reported an increase in profit from $762m to $1322m (73.5 per cent), and Westpac has increased profit from $681m to $1057m (55.2 per cent).

Cumulative equity has increased by 10.0 per cent from $56,248m in 2021 to $61,870m in 2022.

The top eight financial institutions have remained the same eight entities from 2021 to 2022.

Heartland Bank has moved up to the ninth place from 11th place in 2021, pushing AMP Life (10th place) and MUFG Bank (11th place) down one spot each.

- It is noted that certain financial institutions may have released unaudited earnings announcements that are not reflected in the indices or commentary above.