Capital Markets Report: How a record election year will shake up markets – Tim McCready

2024 has been dubbed “the year of the vote”.

There will be more elections this year than ever before in history, and by year-end, countries accounting for over 60 per cent of the world’s economic output and more than half of its population will have voted.

Some of the most consequential elections for the global financial landscape will be the United Kingdom general election on July 4 and the United States presidential election on November 5.

And just last week, India’s stock market took its worst tumble in four years after Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) lost its parliamentary majority in India’s general election.

The US presidential election will be heated.

During the 2020 presidential debates, then-President Donald Trump warned of a market meltdown if Joe Biden was elected. Now, as the Republican Party’s presumptive nominee up against President Biden, Trump is at it again:

“If we lose, you’re gonna have a crash like you wouldn’t believe,” he told attendees at a campaign rally, suggesting his loss would result in “the largest stock market crash we’ve ever had.”

Yet, US stocks have reached record highs this year under President Biden, though Trump has been quick to take credit for the rise.

“This is the Trump stock market,” he posted on his own social media platform, Truth Social. “Because my polls against Biden are so good that investors are projecting that I will win, and that will drive the market up.”

Regardless of the rhetoric, US market analysts tend to agree that trying to attribute financial market performance in the medium to long-term on election outcomes is a fool’s errand.

Returns are more often dependent on economic and inflation trends.

In the current climate, a strengthening economy, corporate profit growth, expectations of interest rate cuts, and the allure of artificial intelligence are key reasons for stock market bullishness.

Trump’s unexpected election win against Hillary Clinton in 2016 did spark a stock market rally fuelled by promises of deregulation, tax cuts and infrastructure spending.

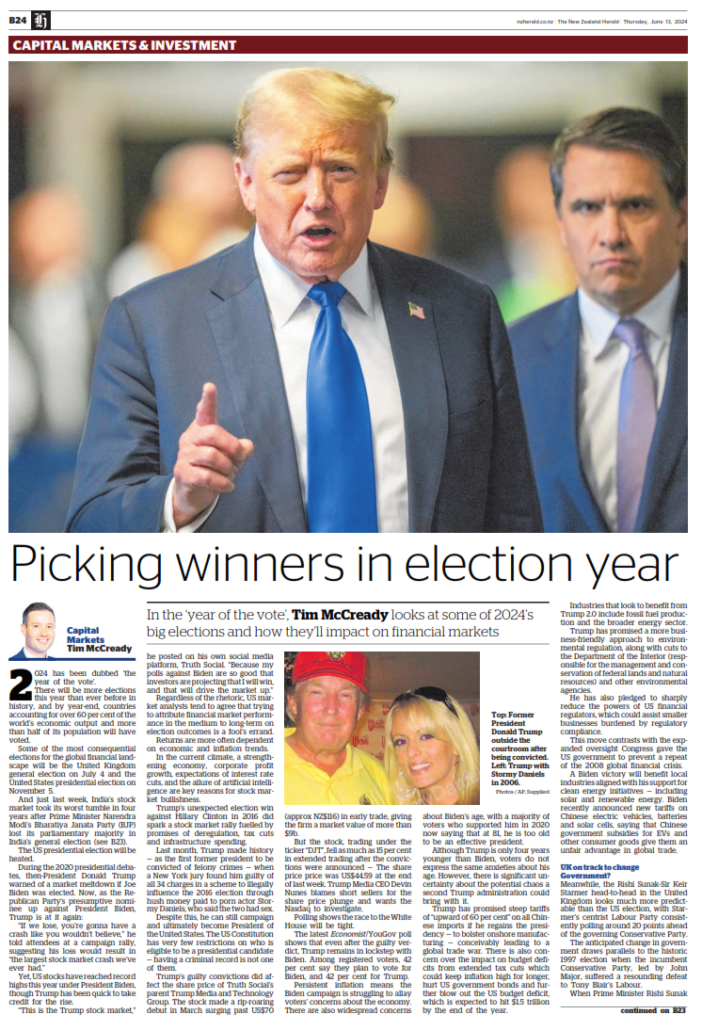

Last month, Trump made history – as the first former president to be convicted of felony crimes – when a New York jury found him guilty of all 34 charges in a scheme to illegally influence the 2016 election through hush money paid to porn actor Stormy Daniels, who said the two had sex.

Despite this, he can still campaign and ultimately become President of the United States. The US Constitution has very few restrictions on who is eligible to be a presidential candidate – having a criminal record is not one of them.

Trump’s guilty convictions did affect the share price of Truth Social’s parent Trump Media and Technology Group. The stock made a rip-roaring debut in March surging past US$70 (approx NZ$116) in early trade, giving the firm a market value of more than $9 billion.

But the stock, trading under the ticker “DJT”, fell as much as 15 per cent in extended trading after the convictions were announced – the share price was US$44.59 at the end of last week. Trump Media CEO Devin Nunes blames short sellers for the share price plunge and wants the Nasdaq to investigate.

Polling shows the race to the White House will be tight.

The latest Economist/YouGov poll shows that even after the guilty verdict, Trump remains in lockstep with Biden. Among registered voters, 42 per cent say they plan to vote for Biden, and 42 per cent for Trump.

Persistent inflation means the Biden campaign is struggling to allay voters’ concerns about the economy. There are also widespread concerns about Biden’s age, with a majority of voters who supported him in 2020 now saying that at 81, he is too old to be an effective president.

Although Trump is only four years younger than Biden, voters do not express the same anxieties about his age. However, there is significant uncertainty about the potential chaos a second Trump administration could bring with it.

Trump has promised steep tariffs of “upward of 60 per cent” on all Chinese imports if he regains the presidency – to bolster onshore manufacturing – conceivably leading to a global trade war. There is also concern over the impact on budget deficits from extended tax cuts which could keep inflation high for longer, hurt US government bonds and further blow out the US budget deficit, which is expected to hit $1.5 trillion by the end of the year.

Industries that look to benefit from Trump 2.0 include fossil fuel production and the broader energy sector. Trump has promised a more business-friendly approach to environmental regulation, along with cuts to the Department of the Interior (responsible for the management and conservation of federal lands and natural resources) and other environmental agencies.

He has also pledged to sharply reduce the powers of US financial regulators, which could assist smaller businesses burdened by regulatory compliance.

This move contrasts with the expanded oversight Congress gave the US government to prevent a repeat of the 2008 global financial crisis.

A Biden victory will benefit local industries aligned with his support for clean energy initiatives — including solar and renewable energy. Biden recently announced new tariffs on Chinese electric vehicles, batteries and solar cells, saying that Chinese government subsidies for EVs and other consumer goods give them an unfair advantage in global trade.

UK on track to change Government?

Meanwhile, the Rishi Sunak-Sir Keir Starmer head-to-head in the United Kingdom looks much more predictable than the US election, with Starmer’s centrist Labour Party consistently polling around 20 points ahead of the governing Conservative Party.

The anticipated change in government draws parallels to the historic 1997 election when the incumbent Conservative Party, led by John Major, suffered a resounding defeat to Tony Blair’s Labour.

When Prime Minister Sunak called the general election much earlier than anticipated last month, financial markets barely reacted to the news. The subdued response can be attributed to several factors. The Labour Party has been polling well ahead of the governing Conservative Party for some time, suggesting a Labour victory is already factored into the market.

The strong lead also means it is unlikely that Labour will adopt any policies that might unsettle the market to attract voters. Labour’s Shadow Chancellor, Rachel Reeves, has added further confidence to the market by committing to a self-imposed fiscal rule that will bind any future Labour government.

This stipulates that government debt as a percentage of GDP must decrease by the fifth year of the official forecast period.

According to a Citi analysis of stock market movements since 1979, UK stocks have historically been “relatively flat to down” in the six months following elections.

The analysis excluded the periods of volatile financial conditions during the dotcom crash and the global financial crisis.

The MSCI UK Index, which tracks the performance of large and mid-cap segments of the UK market, has historically risen by around 6 per cent six months after Labour Party victories, while it has decreased by around 5 per cent following Conservative wins.

The FTSE 250, which has a focus on domestic companies, tends to outperform the large-cap FTSE 100 following elections, particularly after Labour victories.

Sectors expected to benefit from the change in government, include house-building, infrastructure and clean energy projects, with support indicated by Labour.

It has also made bold commitments to enhance the financial services sector, which contributed 12 per cent of the UK’s economic output in 2023. Part of its plan includes making the UK a global hub for green finance, implementing a leading green finance regulatory framework, and collaborating with the financial services sector to support decarbonising homes.

It would also reinvigorate capital markets by reviewing the pensions retirement savings to boost investment in infrastructure and green industries.