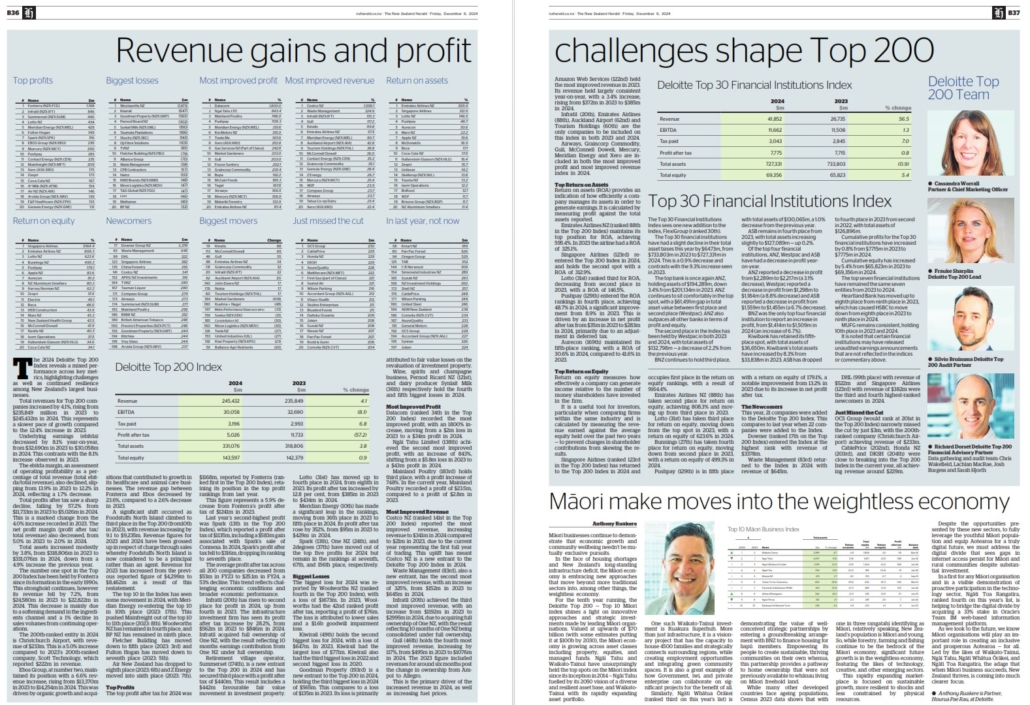

The 2024 Deloitte Top 200 Index reveals a mixed performance across key metrics, highlighting challenges as well as continued resilience among New Zealand’s largest businesses.

Total revenues for Top 200 companies increased by 4.1%, rising from $235,849 million in 2023 to $245,432m in 2024. This represents a slower pace of growth compared to the 12.4% increase in 2023.

Underlying earnings (ebitda) decreased by 8.1% year-on-year, from $32,690m in 2023 to $30,058m in 2024. This contrasts with the 8.1% increase observed in 2023.

The ebitda margin, an assessment of operating profitability as a percentage of total revenue (total ebitda/total revenue), also declined, slipping from 13.9% in 2023 to 12.2% in 2024, reflecting a 1.7% decrease.

Total profits after tax saw a sharp decline, falling by 57.2% from $11,733m in 2023 to $5,026m in 2024. This is a marked change from the 4.0% increase recorded in 2023. The net profit margin (profit after tax/total revenue) also decreased, from 5.0% in 2023 to 2.0% in 2024.

Total assets increased modestly by 3.8%, from $318,806m in 2023 to $331,076m in 2024, down from a 4.9% increase the previous year.

The No 1 spot in the Top 200 Index has been held by Fonterra since its formation in the early 1990s. This stronghold continues, however, its revenue fell by 7.2%, from $24,580m in 2023 to $22,822m in 2024. This decrease is mainly because of a softening demand in the ingredients channel and a 1% decline in sales volumes from continuing operations.

The 200th-ranked entity in 2024 is Christchurch Airport, with revenue of $233m. This is a 5.0% increase compared to 2023’s 200th-ranked company, Scott Technology, which reported $222m in revenue.

Ebos Group, at No 2, maintained its position with a 6.6% revenue increase, rising from $13,370m in 2023 to $14,254m in 2024. This was driven by organic growth and acquisitions that contributed to growth in its healthcare and animal care businesses. The revenue gap between Fonterra and Ebos decreased by 23.6%, compared to a 2.6% decrease in 2023.

A significant shift occurred as Foodstuffs North Island climbed to third place in the Top 200 (from 10th in 2023), with revenue increasing by 9.1 to $9,235m. Revenue figures for 2023 and 2024 have been grossed up in respect of charge through sales whereby Foodstuffs North Island is now considered to be a principal rather than an agent. Revenue for 2023 has increased from the previous reported figure of $4,299m to $8,462m as a result of this restatement.

The top 10 in the Index has seen some movement in 2024, with Meridian Energy re-entering the top 10 in 10th place (2023: 17th). This pushed Mainfreight out of the top 10 to 11th place (2023: 8th). Woolworths NZ has remained in fourth place, and BP NZ has remained in ninth place.

Fletcher Building has moved down to fifth place (2023: 3rd) and Fulton Hogan has moved down to seventh place (2023: 5th).

Air New Zealand has dropped to eighth place (2023: 6th) and Z Energy moved into sixth place (2023: 7th).

Top profits

The top profit after tax for 2024 was $1168m, reported by Fonterra (ranked first in the Top 200 Index), retaining its position in the top profit rankings from last year.

This figure represents a 5.9% decrease from Fonterra’s profit after tax of $1241m in 2023.

Last year’s second-highest profit was Spark (13th in the Top 200 Index), which reported a profit after tax of $1135m, including a $583m gain associated with Spark’s sale of Connexa. In 2024, Spark’s profit after tax fell to $316m, dropping its ranking to seventh place.

The average profit after tax across all 200 companies decreased from $53m in FY23 to $25.1m in FY24, a 53% decline. This trend reflects challenging economic conditions and broader economic performance.

Infratil (20th) has risen to second place for profit in 2024, up from fourth in 2023. The infrastructure investment firm has seen its profit after tax increase by 28.2%, from $562m in 2023 to $846m in 2024. Infratil acquired full ownership of One NZ, with the result reflecting 10 months’ earnings contribution from One NZ under full ownership.

Retirement village operator, Summerset (174th), is a new entrant to the Top 200 in 2024 and has secured third place with a profit after tax of $440m. This result includes a $442m favourable fair value movement in investment property.

Lotto (31st) has moved up to fourth place in 2024, from eighth in 2023. Its profit after tax increased by 12.8%, from $385m in 2023 to $434m in 2024.

Meridian Energy (10th) has made a significant leap in the rankings, moving from 36th place in 2023 to fifth place in 2024. Its profit after tax rose by 352%, from $95m in 2023 to $429m in 2024.

Spark (13th), One NZ (24th), and 2degrees (37th) have moved out of the top five profits for 2024 but remain in the rankings at seventh, 67th, and 156th place, respectively.

Biggest losses

The biggest loss for 2024 was reported by Woolworths NZ (ranked fourth in the Top 200 Index), with a loss of $1673m. In 2023, Woolworths had the 42nd ranked profit after tax, reporting a profit of $76m. The loss is attributed to lower sales and a $1.6b goodwill impairment loss.

KiwiRail (49th) holds the second biggest loss for 2024, with a loss of $647m. In 2023, KiwiRail had the largest loss of $771m. KiwiRail also had the third biggest loss in 2022 and second biggest loss in 2020.

Goodman Property (193rd) is a new entrant to the Top 200 in 2024, holding the third biggest loss in 2024 of $565m. This compares to a loss of $135m in 2023. Its loss is primarily attributed to fair value losses on the revaluation of investment property.

Wine, spirits and champagne business, Pernod Ricard NZ (121st), and dairy producer Synlait Milk (36th) respectively hold the fourth and fifth biggest losses in 2024.

Most improved profit

Datacom (ranked 34th in the Top 200 Index) recorded the most improved profit, with an 1800% increase, moving from a $2m loss in 2023 to a $34m profit in 2024.

Ngāi Tahu Ltd (138th) achieved the second most improved profit, with an increase of 843%, shifting from a $5.8m loss in 2023 to a $43m profit in 2024.

Mainland Poultry (183rd) holds third place, with a profit increase of 748%. In the current year, Mainland Poultry recorded a profit of $23.5m, compared to a profit of $2.8m in 2023.

Most improved revenue

Costco NZ (ranked 141st in the Top 200 Index) reported the most improved revenue, increasing revenue to $341m in 2024 compared to $21m in 2023, because the current year represents the first full year of trading. This uplift has meant Costco NZ is a new entrant to the Deloitte Top 200 Index in 2024.

Waste Management (83rd), also a new entrant, has the second most improved revenue, with an increase of 325%, from $152m in 2023 to $645m in 2024.

Infratil (20th) achieved the third most improved revenue, with an increase from $1192m in 2023 to $2995m in 2024, because of acquiring full ownership of One NZ, with the result reflecting 10 months of One NZ being consolidated under full ownership.

Gull (46th) holds the fourth most improved revenue, increasing by 117%, from $495m in 2023 to $1076m in 2024. The 2023 figure included revenues for around six months post the change in ownership from Ampol to Allegro.

This is the primary driver of the increased revenue in 2024, as well as increasing fuel prices.

Amazon Web Services (122nd) held the most improved revenue in 2023. Its revenue held largely consistent year-on-year, with a 3.4% increase, rising from $372m in 2023 to $385m in 2024.

Infratil (20th), Emirates Airlines (88th), Auckland Airport (62nd) and Tourism Holdings (60th) are the only companies to be included on this index in both 2023 and 2024.

Airways, Graincorp Commodity, Gull, McConnell Dowell, Mercury, Meridian Energy and Xero are included in both the most improved profit and most improved revenue index in 2024.

Return on assets (ROA) provides an indication of how efficiently a company manages its assets in order to generate earnings. It is calculated by measuring profit against the total assets reported.

Emirates Airlines NZ (ranked 88th in the Top 200 Index) maintains its top position for ROA, achieving 595.4%. In 2023 the airline had a ROA of 325.1%.

Singapore Airlines (123rd) re-entered the Top 200 Index in 2024, and holds the second spot with a ROA of 312.9%.

Lotto (31st) ranked third for ROA, decreasing from second place in 2023, with a ROA of 146.5%.

Pushpay (129th) entered the ROA rankings in fourth place, achieving 48.7% in 2024, a significant improvement from 8.9% in 2023. This is driven by an increase in net profit after tax from $35m in 2023 to $283m in 2024, primarily because of an adjustment in deferred tax.

Aurecon (169th) maintained its fifth-place ranking, with a ROA of 30.6% in 2024, compared to 41.6% in 2023.

Return on equity measures how effectively a company can generate income relative to the amount of money shareholders have invested in the firm.

It is a useful tool for investors, particularly when comparing firms within the same industry and is calculated by measuring the revenue earned against the average equity held over the past two years – to prevent changes in shareholder contributions from skewing the results.

Singapore Airlines (ranked 123rd in the Top 200 Index) has returned to the Top 200 Index in 2024 and occupies first place in the return on equity rankings, with a result of 9164.4%.

Emirates Airlines NZ (88th) has taken second place for return on equity, achieving 808.3% and moving up from third place in 2023.

Lotto (31st) has taken third place for return on equity, moving down from the top spot in 2023, with a return on equity of 623.6% in 2024.

Bunnings (27th) has taken fourth place for return on equity, moving down from second place in 2023, with a return on equity of 499.3% in 2024.

Pushpay (129th) is in fifth place with a return on equity of 179.1%, a notable improvement from 13.2% in 2023 because of its increase in net profit after tax.

This year, 21 companies were added to the Deloitte Top 200 Index. This compares to last year when 22 companies were added to the Index.

Downer (ranked 17th on the Top 200 Index) entered the Index at the highest rank with revenue of $3378m.

Waste Management (83rd) returned to the Index in 2024 with revenue of $645m.

DHL (99th place) with revenue of $522m and Singapore Airlines (123rd) with revenue of $382m were the third and fourth highest-ranked newcomers in 2024.

Just missed the cut

OCS Group (would rank at 201st in the Top 200 Index) narrowly missed the cut by just $3m, with the 200th-ranked company (Christchurch Airport) achieving revenue of $233m.

CablePrice (202nd), Honda NZ (203rd), and DKSH (204th) were close to breaking into the Top 200 Index in the current year, all achieving revenue around $229m.

The Top 30 Financial Institutions Index sees one new addition to the Index, FlexiGroup (ranked 30th).

The Top 30 financial institutions have had a slight decline in their total asset bases this year by $6473m, from $733,803m in 2023 to $727,331m in 2024. This is a 0.9% decrease and contrasts with the 9.3% increase seen in 2023.

The top bank is once again ANZ, holding assets of $194,289m, down 3.4% from $201,134m in 2023. ANZ continues to sit comfortably in the top spot, with a $61,491m gap in total asset value between first place and second place (Westpac). ANZ also outpaces all other banks in terms of profit and equity.

The second place in the Index has been held by Westpac in both 2023 and 2024, with total assets of $132,798m – a decrease of 2.2% from the previous year.

BNZ continues to hold third place, with total assets of $130,065m, a 1.0% decrease from the previous year.

ASB remains in fourth place from 2023, with total assets increasing slightly to $127,089m – up 0.2%.

Of the top four financial institutions, ANZ, Westpac and ASB have had a decrease in profit year-on-year.

ANZ reported a decrease in profit from $2,289m to $2,217m (a 3.1% decrease), Westpac reported a decrease in profit from $1,298m to $1,184m (a 8.8% decrease) and ASB reported a decrease in profit from $1,559m to $1,455m (a 6.7% decrease).

BNZ was the only top four financial institution to report an increase in profit, from $1,414m to $1,509m in 2024 (an increase of 6.7%).

Kiwibank has retained its fifth-place spot, with total assets of $36,650m. Kiwibank’s total assets have increased by 8.3% from $33,838m in 2023. ASB has dropped to fourth place in 2023 from second in 2022, with total assets of $126,896m.

Cumulative profits for the Top 30 financial institutions have increased by 0.8% from $7715m in 2023 to $7775m in 2024.

Cumulative equity has increased by 5.4% from $65,823m in 2023 to $69,356m in 2024.

The top seven financial institutions have remained the same seven entities from 2023 to 2024.

Heartland Bank has moved up to eighth place from ninth place in 2023, which has caused HSBC to move down from eighth place in 2023 to ninth place in 2024.

MUFG remains consistent, holding 10th place in 2023 and 2024.

It is noted that certain financial institutions may have released unaudited earnings announcements that are not reflected in the indices or commentary above.