Deloitte Top 200: Fonterra, Rocket Lab standout performers among top index

The 2025 Deloitte Top 200 Index reflects a year of steady but uneven performance, with modest revenue growth, a rebound in profitability, and continued shifts in sector dynamics as New Zealand’s largest organisations adapt to changing economic conditions.

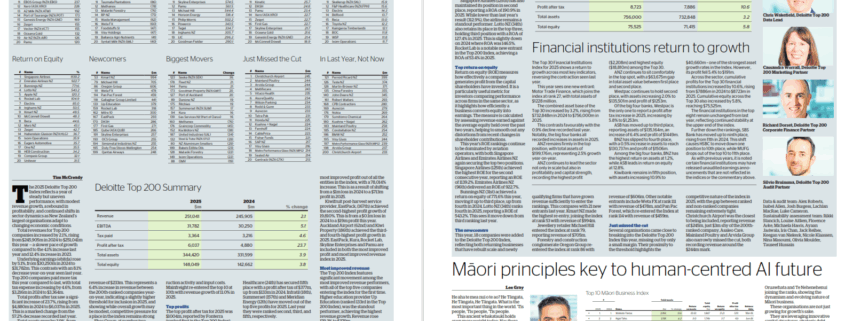

Total revenues for Top 200 companies increased by 2.1%, rising from $245,905m in 2024 to $251,041m in 2025. This represents a slower pace of growth compared to the 4.1% increase last year and 12.4% increase in 2023.

Underlying earnings (Ebitda) rose by 5.1%, from $30,250m in 2024 to $31,782m in 2025. This contrasts with an 8.1% decrease year-on-year seen in 2024.

Top 200 companies paid more tax this year compared to last, with total tax expense increasing by 4.6%, from $3,216m in 2024 to $3,364m in 2025.

Total profits after tax saw a significant increase of 23.7%, rising from $4,880m in 2024 to $6,037m in 2025. This is a marked change from the 57.2% decrease recorded in 2024.

Total assets grew by 3.9%, from $331,599m in 2024 to $344,420m in 2025. This is similar to last year where total assets grew 3.8%.

The number one spot in the Top 200 Index has been held by Fonterra since the Index’s formation in the early 1990s. This stronghold continues, with the co-operative’s revenue increasing by 5.6% during the year to $24,111m in 2025 from $22,822m in 2024. This compares to a fall in revenue last year of 7.2%. The increase this year has been driven by higher milk prices, increased milk collections, and strong demand for Foodservice and Ingredients. Fonterra’s continued leadership underscores both its scale and the central role it plays within the wider New Zealand export economy.

The 200th-ranked entity in the Top 200 Index in 2025 is personal care and hygiene company Asaleo Care, with revenue of $248m. Last year’s 200th ranked company, Christchurch Airport, had revenue of $233m. This represents a 6.4% increase in revenue between the 200th ranked companies year-on-year, indicating a slightly higher threshold for inclusion in 2025. This rising threshold shows that while overall growth may be modest, competitive pressure for a place in the Index remains strong.

Ebos Group, at number two, maintained its position in the Index. This is despite a drop in revenue of 5.6%, decreasing from $14,254m in 2024 to $13,451m in 2025. The revenue decline was driven by the loss of the Chemist Warehouse Australia wholesale contract at the end of FY24. The revenue gap between the top two companies widened slightly due to Fonterra’s stronger growth.

The top 10 in the Index saw moderate movement in 2025.

Foodstuffs North Island and Woolworths continue to occupy the third and fourth place, respectively. Z Energy moved up from sixth place last year to fifth place, albeit with revenue that declined by 5.6% in 2025.

Fletcher Building dropped from fifth to sixth place after a challenging year in construction saw its revenue reduce by 9.0% in 2025. The shift reflects the series of sector-wide pressures impacting construction activity and input costs.

Mainfreight re-entered the top 10 at tenth (up from 11th in 2024), with revenue growth of 11.0% in 2025.

Top Profits

The top profit after tax for 2025 was $1004m, reported by Fonterra (ranked first in the Top 200 Index), retaining its position in the top profit rankings from last year.

This figure represents a 14% decrease from Fonterra’s profit after tax of $1168m in 2024. Despite the decline, the magnitude of Fonterra’s earnings means it still outperforms all other entities by a considerable margin.

Forestry business Kaingaroa Timberlands (ranked 99th in the Index) recorded the second highest profit after tax of $713m, which was driven by an uplift in the fair value of its forestry assets.

Auckland Airport (ranked 62nd) holds the third highest profit after tax of $421m in 2025. This is up from $6m in 2024, and was largely driven by a deferred tax impact from changes to building structure depreciation legislation in 2024 of $292m.

Lotto NZ (ranked 34th) maintains its fourth place profit after tax ranking, with a result of $405m (2024: $434m).

F&P Healthcare (ranked 24th) has secured fifth place with a profit after tax of $377m, up from $133m in 2024.

Infratil (ranked 18th), Summerset (157th) and Meridian Energy (12th) have moved out of the top five profits for 2025. Last year they were ranked second, third, and fifth, respectively.

Biggest Losses

The biggest loss for 2025 was reported by Meridian Energy (ranked 12th in the Top 200 Index), with a loss of $452m. It was impacted by historically low hydro inflows, and high gas costs.

Ryman Healthcare (ranked 77th) holds the second biggest loss for 2025, with a loss of $437m.

KiwiRail (46th) holds the third biggest loss, with a loss after tax of $422m. KiwiRail has been a regular mention in the biggest losses list over the last few years. Last year it held the second biggest loss, with a loss of $647m and in 2023 it had the largest loss of $771m. KiwiRail also had the third biggest loss in 2022 and second biggest loss in 2020.

Fletcher Building (6th) and Infratil (18th) respectively hold the fourth and fifth biggest losses in 2025.

Most Improved Profit

Kaingaroa Timberlands (ranked 99th in the Top 200 Index) recorded the most improved profit out of all the entities in the Index, with a 78,014% increase. This is as a result of shifting from a $1m loss in 2024 to a $713m profit in 2025.

Kiwifruit post-harvest service provider, EastPack, (167th) achieved the second highest profit growth of 19,810%. This is from a $0.1m loss in 2024 to a $19m profit in 2025.

Auckland Airport (62nd) and Kiwi Property (186th) achieved the third and fourth highest profit growth in 2025.

EastPack, Kura, Rocket Lab, Skyline Enterprises and Pamu are included in both the most improved profit and most improved revenue index in 2025.

Most Improved Revenue

The Top 200 Index features significant movement among the most improved revenue performers, with all of the top five companies entering the Index for the first time.

Higher education provider Up Education (ranked 133rd in the Top 200 Index), was the standout performer, achieving the highest revenue growth. Revenue rose 179.3% to $379m.

Forest products business, Pan Pac Forest Products (114th), achieved the second highest revenue growth, with an increase of 121.8% to $459m. This reflects its recovery following the severe impacts of Cyclone Gabrielle in 2023.

Rocket Lab (159th) recorded the third highest revenue growth, rising 61.3% to $318m.

Duty Free Stores Wellington (195th) delivered the fourth highest revenue uplift, growing revenue by 50.9% to $254m.

EastPack (167th) rounded out the top five most improved revenue performers, achieving revenue growth of 47.8% to $293m.

Top Return on Assets

Return on assets (ROA) is a key indicator of how efficiently an organisation uses its asset base to generate earnings. By comparing profit with total reported assets, ROA highlights those companies that are achieving strong returns relative to the scale of their operations. This year’s results again show significant variation across sectors, with aviation operators continuing to dominate the top of the Index.

Emirates Airlines NZ (ranked 96th in the Top 200 Index) has once again taken the top position for ROA, achieving 713.8% in 2025. This is an increase from 595.4% last year and 325.1% in 2023 and reflects another strong year relative to its asset base.

Singapore Airlines (125th) has also maintained its position in second place, reporting a ROA of 190.9% in 2025. While lower than last year’s result (312.9%), the airline remains a standout performer in these rankings.

Lotto NZ (34th) also retains its place in the top three, holding third position with a ROA of 127.4% in 2025. This is slightly down on 2024 where ROA was 146.5%.

Rocket Lab is a notable new entrant in the Top 200 Index, achieving a ROA of 53.4% in 2025.

Top Return on Equity

Return on equity (ROE) measures how effectively a company generates profit from the capital shareholders have invested.

It is a particularly useful metric for investors comparing performance across firms in the same sector, as it highlights how efficiently a business converts equity into earnings. The measure is calculated by assessing revenue earned against the average equity held over the past two years, helping to smooth out any distortions from recent changes in shareholder contributions.

This year’s ROE rankings continue to be dominated by aviation operators, with both Singapore Airlines and Emirates Airlines NZ again securing the top two positions.

Singapore Airlines (125th) achieved the highest ROE for the second consecutive year, reporting an ROE of 1139.2% in 2025.

Emirates Airlines NZ (96th) delivered an ROE of 922.7%.

Bunnings NZ (31st) achieved a return on equity of 771.6% in 2025, moving it up to third place, up from fourth in 2024.

Lotto NZ (34th) ranks fourth in 2025, reporting a ROE of 543.2%. This sees it move down from third ranking last year.

The Newcomers

This year, 18 companies were added to the Deloitte Top 200 Index, reflecting both returning businesses that have rebuilt scale and newly qualifying firms that have grown revenue sufficiently to enter the rankings. This compares with 21 new entrants last year.

Kmart NZ made the highest re-entry in 2025, joining the Index at rank 53 with revenue of $994m.

Jewellery retailer Michael Hill entered the Index at rank 79, reporting revenue of $705m.

Forestry and construction conglomerate Oregon Group re-entered the Index at rank 86 with revenue of $606m.

Other notable entrants include Weta FX at rank 111 with revenue of $478m, and Pan Pac Forest, which re-entered the Index at rank 114 with revenue of $459m.

Just Missed the Cut

Several organisations came close to breaking into the Deloitte Top 200 Index this year, missing out by only a small margin. Their proximity to the threshold highlights the competitive nature of the Index in 2025, with the gap between ranked and non-ranked companies remaining extremely tight.

Christchurch Airport was the closest to being included, reporting revenue of $245m, just $3m shy of the 200th-ranked company, Asaleo Care.

Mainland Poultry and Arvida Group also narrowly missed the cut, both recording revenue around the $244m mark.