Deloitte Top 200 2025: Top 30 financial institutions lift profits 10.6% in 2025

The Top 30 Financial Institutions Index for 2025 shows a return to growth across most key indicators, reversing the contraction seen last year.

This year sees one new entrant: Motor Trade Finance, which joins the index at rank 27, with total assets of $1228 million.

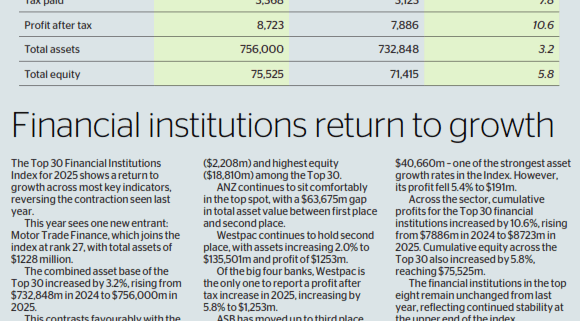

The combined asset base of the Top 30 increased by 3.2%, rising from $732,848m in 2024 to $756,000m in 2025. This contrasts favourably with the 0.9% decline recorded last year. Notably, the big four banks all recorded increases in assets in 2025.

ANZ remains firmly in the top position, with total assets of $199,176m, representing 2.5% growth year-on-year. ANZ continues to lead the sector not only in scale but also in profitability and capital strength, recording the highest profit ($2,208m) and highest equity ($18,810m) among the Top 30.

Westpac continues to hold second place, with assets increasing 2.0% to $135,501m and profit of $1253m. Of the big four banks, Westpac is the only one to report a profit after tax increase in 2025, increasing by 5.8% to $1,253m.

ASB has moved up to third place, reporting assets of $135,164m, an increase of 6.4% and profit of $1449m.

BNZ has slipped to fourth place, with a 0.5% increase in assets to reach $130,737m and profit of $1506m.

Kiwibank remains in fifth position, with assets increasing 10.9% to $40,660m – one of the strongest asset growth rates in the Index. However, its profit fell 5.4% to $191m.

Across the sector, cumulative profits for the Top 30 financial institutions increased by 10.6%, rising from $7886m in 2024 to $8723m in 2025. Cumulative equity across the Top 30 also increased by 5.8%, reaching $75,525m.

The financial institutions in the top eight remain unchanged from last year, reflecting continued stability at the upper end of the index.

Further down the rankings, SBS Bank has moved up to ninth place, rising from 11th in 2024. This shift causes HSBC to move down one position to 10th place, while MUFG drops out of the top 10 to 11th place.

As with previous years, it is noted that certain financial institutions may have released unaudited earnings announcements that are not reflected in the indices or the commentary above.