Dynamic Business: Dilhan Fernando on how Dilmah stays true to values in a profit‑first world

For a company headquartered 11,000 kilometres away in South Asia, Dilmah is unusually entrenched in New Zealand’s cultural memory. Much of that comes down to one man – Merrill Fernando – and the iconic line he delivered in TV advertisements some 30 years ago: “Do try it.”

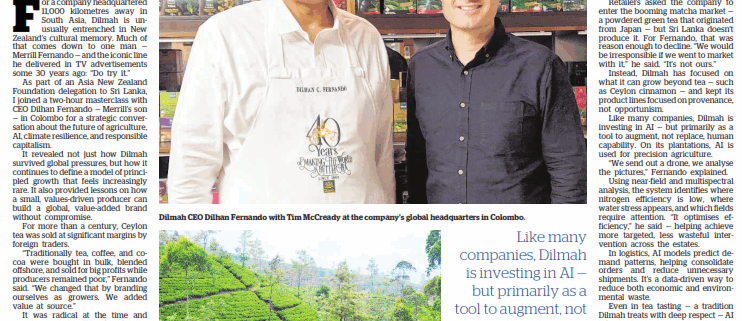

As part of an Asia New Zealand Foundation delegation to Sri Lanka, I joined a two-hour masterclass with CEO Dilhan Fernando – Merrill’s son – in Colombo for a strategic conversation about the future of agriculture, AI, climate resilience, and responsible capitalism.

It was a session that revealed not just how Dilmah survived global pressures, but how it continues to define a model of principled growth that feels increasingly rare. It also provided lessons for New Zealand on how a small, values-driven producer can build a global, value-added brand without compromise.

The cost of doing the right thing

For more than a century, Ceylon tea was sold at significant margins by foreign traders.

That simple act was radical at the time and remains central to Dilmah’s identity. It’s a mindset he says New Zealanders instinctively understand.

“New Zealanders understand the connection between nature and taste,” said Fernando. “While the importance of ingredients is shared by your wine and dairy industries, around the world I see that respect for artisanship and for ingredients disappearing, sacrificed to discounts and so on.”

Many organisations have been softening or retreating from environmental, social, and governance (ESG) commitments recently, driven by regulatory uncertainty, political pushback, and rising scepticism about real-world impact and costs. Yet Dilmah has held firm – even when it costs.

“Of course, we took the logical step and walked away”.

The decision significantly dropped Dilmah’s market share overnight, but for Fernando, the company’s purpose was non-negotiable.

“Most CEOs have a three-month timeframe. But we think in generations. We are responsible for an ecosystem that includes people and nature.”

Last year was Dilmah’s worst on record for profit – yet it was its greatest for impact.

More than one billion Sri Lankan rupees were invested through its foundation in education, healthcare, disability services, climate science, food programmes, and Sri Lanka’s post-conflict rehabilitation.

“Success is important,” said Fernando. “But significance is success expressed in the lives of others.”

The commitment extends beyond Sri Lanka. “We work in New Zealand with hospice, with the homeless through different organisations,” he said. “In Australia as well, through the Salvation Army, with people struggling with substance abuse and with the homeless.”

Together, these efforts shape a view of business that goes beyond profit. “You realise the purpose of business,” Fernando said. “And you understand what really motivates a business to do more.”

But he was also frank about the pressure ethical businesses face. “The challenge businesses have in doing the right thing today is something exceptional.”

He outlined the realities of sustainable farming: “Looking after the soil, using biochar, biological control for pest management, agroforestry methods. Unfortunately, when you do the right thing, you generally pay a high price for it.”

And yet, that struggle is central to Dilmah’s identity. “It motivates us,” he said simply. “It makes us leaner, fitter.”

Dilmah’s approach to product development also reflects a refusal to compromise.

Retailers asked the company to enter the booming matcha market – a powdered green tea that originated from Japan – but Sri Lanka doesn’t produce it. For Fernando, that was reason enough to decline.

“We would be irresponsible if we went to market with it,” he said. “It’s not ours.”

Instead, Dilmah has focused on what it can grow beyond tea – such as Ceylon cinnamon – and kept its product lines focused on provenance, not opportunism.

AI that strengthens tradition

Like many companies, Dilmah is investing in AI – but primarily as a tool to augment, not replace, human capability.

On its plantations, AI is used for precision agriculture. “We send out a drone, we analyse the pictures,” Fernando explained. Using near-field and multispectral analysis, the system identifies where nitrogen efficiency is low, where water stress appears, and which fields require attention. “It optimises efficiency,” he said – helping achieve more targeted, less wasteful intervention across the estates.

In logistics, AI models predict demand patterns, helping consolidate orders and reduce unnecessary shipments. It’s a data-driven way to reduce both economic and environmental waste.

Even in tea tasting – a tradition Dilmah treats with deep respect – AI is beginning to play a supporting role. Dilmah’s team tastes around 12,000 teas each week, selecting only the best for its range.

“We use AI to augment that,” Fernando said. Liquor from each batch is run through hyperspectral analysis, creating detailed flavour profiles. The goal is to “create a flavour map” of the many terroirs across the island. “It’s not a replacement for tasters, but another element to support them in their evaluation.”

In a global market where it’s becoming easier to dilute principles than hold them, Dilmah has built a business by refusing to compromise.

Thirty years after Merrill Fernando first invited New Zealanders to “Do try it”, the line still resonates – not only as a tagline for tea, but as a challenge to the business world.

Tim McCready joined the Asia New Zealand Foundation’s delegation to Sri Lanka.